Updated on October 21st, 2024 by Bob Ciura

Spreadsheet data updated daily

The technology industry is one of the most exciting areas of the stock market, known for its rapid growth and propensity to create rapid and life-changing wealth for early investors.

Until recently, the technology sector was not known for being a source of high-quality dividend investment ideas. This is no longer the case.

Today, some of the most appealing dividend stocks come from the tech sector.

With that in mind, we’ve compiled a list of 130+ technology stocks complete with important investing metrics, which you can access below:

The holdings of the technology stocks list were derived from the following major exchange-traded funds:

- Technology Select Sector SPDR ETF (XLK)

- Invesco S&P SmallCap Information Technology ETF (PSCT)

Keep reading this article to learn more about the benefits of investing in dividend-paying technology stocks.

In addition to providing a full spreadsheet of tech stocks and how to use the spreadsheet, we give our top 10-ranked tech stocks today in terms of 5-year expected annual returns.

Table Of Contents

The following table of contents allows you to instantly jump to any section:

- How To Use The Tech Stocks List

- Why Invest In The Technology Sector?

- The Top 10 Tech Stocks Today

Tech Dividend Stock #10: Roper Technology (ROP)

Tech Dividend Stock #9: TE Connectivity (TEL)

Tech Dividend Stock #8: Analog Devices (ADI)

Tech Dividend Stock #7: Qualcomm Inc. (QCOM)

Tech Dividend Stock #6: Cognizant Technology Solutions (CTSH)

Tech Dividend Stock #5: Microsoft Corporation (MSFT)

Tech Dividend Stock #4: NXP Semiconductors (NXPI)

Tech Dividend Stock #3: Juniper Networks (JNPR)

Tech Dividend Stock #2: Applied Materials (AMAT)

Tech Dividend Stock #1: Intuit Inc. (INTU)

How To Use The Technology Stocks List To Find Dividend Investment Ideas

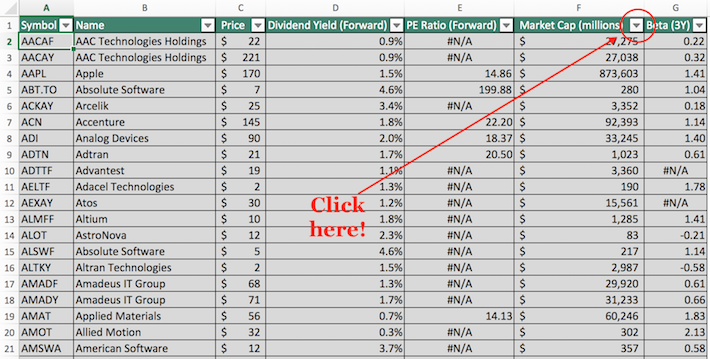

Having an Excel document containing the names, tickers, and financial metrics for all dividend-paying technology stocks can be extremely powerful.

The document becomes significantly more powerful if the user has a working knowledge of Microsoft Excel.

With that in mind, this section will show you how to implement two actionable investing screens to the technology stocks list. The first screen that we’ll implement is for stocks with dividend yields above 3%.

Screen 1: High Dividend Yield Technology Stocks

Step 1: Download the technology stocks list at the link above.

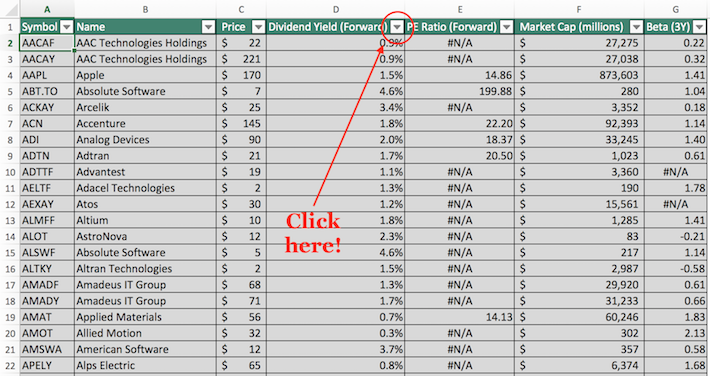

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

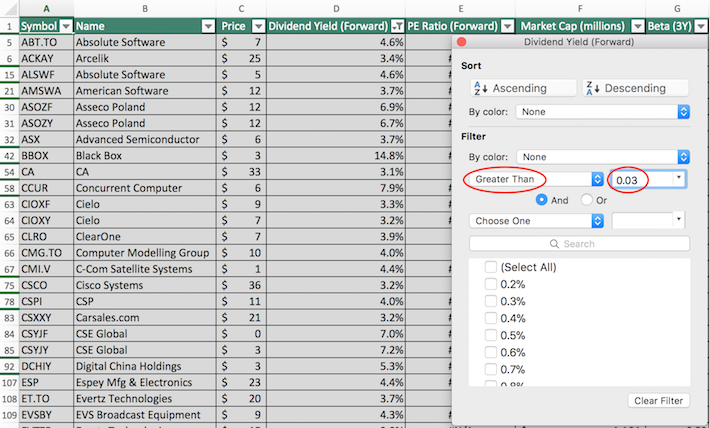

Step 3: Change the filter setting to “Greater Than” and input 0.03 into the field beside it, as shown below.

The remaining stocks in this spreadsheet are dividend-paying technology stocks with dividend yields above 3%, which provide a basket of securities that should appeal to retirees and other income-oriented investors.

The next section will show you how to simultaneously screen for stocks with price-to-earnings ratios below 20 and market capitalizations above $10 billion.

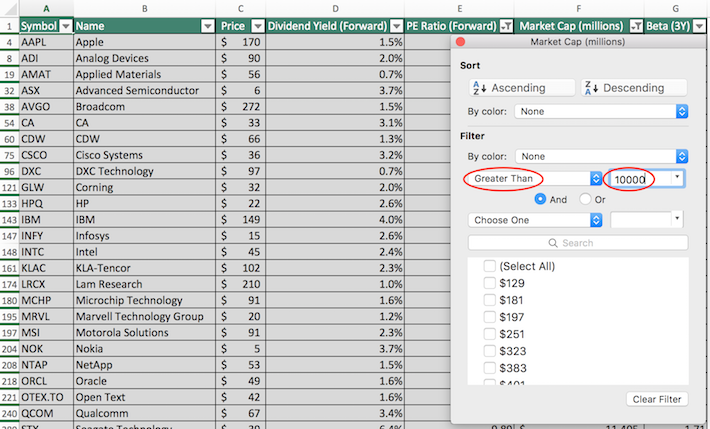

Screen 2: Low Price-to-Earnings Ratios, Large Market Capitalizations

Step 1: Download the technology stocks list at the link above.

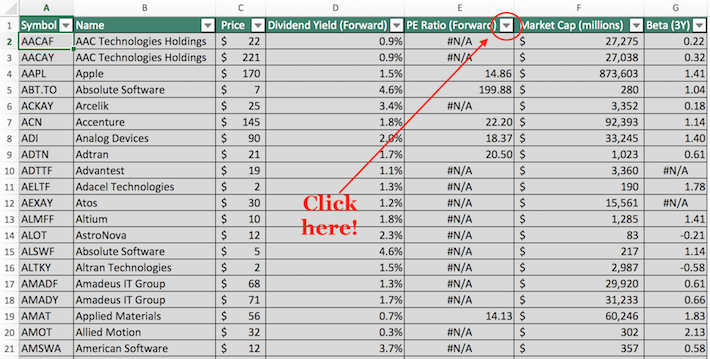

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

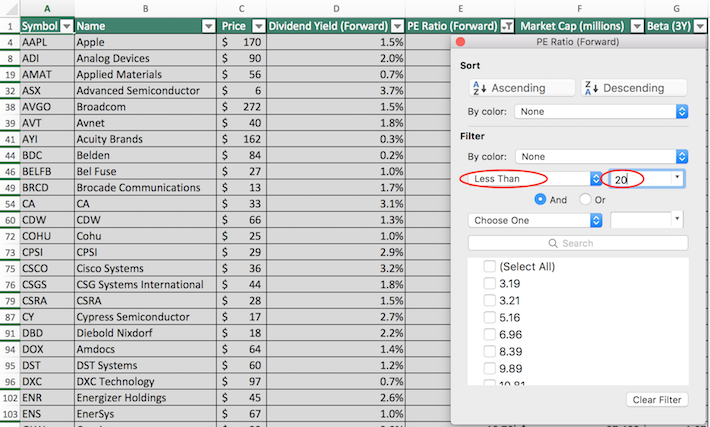

Step 3: Change the filter setting to “Less Than” and input 20 into the field beside it, as shown below.

Step 4: Exit out of the filter window (by clicking the exit button, not by clicking the Clear Filter button). Then, click on the filter icon at the top of the market capitalization button, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 10000 into the field beside it, as shown below. Note that since market capitalization is measured in millions of dollars in this spreadsheet, inputting “$10,000 million” is equivalent to screening for stocks with market capitalizations above $10 billion.

The remaining stocks in the Excel spreadsheet are dividend-paying technology stocks with price-to-earnings ratios below 20 and market capitalizations above $10 billion. The size and reasonable valuation of these businesses make this a useful screen for value-conscious, risk-averse investors.

You now have an understanding of how to use the technology stocks list to find investments with certain financial characteristics. The remainder of this article will discuss the relative merits of investing in the technology sector.

Why Invest In The Technology Sector?

The technology industry is known for having some of the best-performing stocks over short periods of time. Indeed, it’s hard to overstate how much wealth was created for the early investors in companies like Microsoft (MSFT) or Apple (AAPL).

In addition, the technology sector is highly diversified. It includes everything from social media companies to semiconductor stocks. The technology sector itself is not a monolith; there are many types of businesses within the sector.

Unfortunately, the technology industry is also known for causing one of the most dramatic stock market bubbles on record. The 2000-2001 dot-com bubble destroyed billions of dollars of market value because technology stocks were trading at such irrationally high valuations.

Source: YCharts

This notable bear market might lead some investors to avoid the technology sector entirely.

Fortunately, today’s technology sector is tremendously different from its predecessor in the early 2000s. While technology stocks were previously valued based on page views or other vanity metrics, this school of thought has changed significantly.

Today’s technology stocks are valued based on the same yardsticks as other businesses: earnings, free cash flow, and, to a lesser extent, assets.

Moreover, careful security analysis allows investors to find undervalued technology stocks and profits, just as with any other industry.

Investors might also avoid tech stocks because of a perceived inability to understand how they make money.

While some investors ignore technology stocks because of their harder-to-understand business models, it’s important to note that not all technology stocks have business operations that are shrouded in complexity.

As an example, Apple has a very simple business model. The company manufactures and sells iPhones, Mac computers, and wearable devices. It also makes money from services through its hardware devices such as the App Store and iTunes.

Moreover, one could argue that Apple’s greatest strength is not its technology, but its brand – similar to many non-technology companies like the Coca-Cola Company (KO), Procter & Gamble (PG), and Colgate-Palmolive (CL).

Importantly, there are opportunities similar to Apple throughout the sector – not all technology stocks have competitive advantages that are based on microchip capacity or cloud computing speed.

The last reason why technology stocks can play an important role in your investment portfolio is that they have the potential to be very strong dividend stocks.

Historically, the technology sector was devoid of any appealing dividend investments because technology firms reinvested all money to drive rapid organic growth.

This is no longer the case, at least not in general. Many technology firms now pay steadily rising dividends year in and year out.

The profits of these large, stable technology companies are only growing. And, many technology firms have fairly low payout ratios.

These factors lead us to believe that the technology sector will continue to provide strong dividend growth investment opportunities for the foreseeable future.

The Top 10 Tech Stocks Today

With all that said, the following 10 stocks represent our highest-ranked tech stocks in the Sure Analysis Research Database, in terms of 5-year expected annual returns.

Rankings are listed in order of expected total annual returns, in order from lowest to highest.

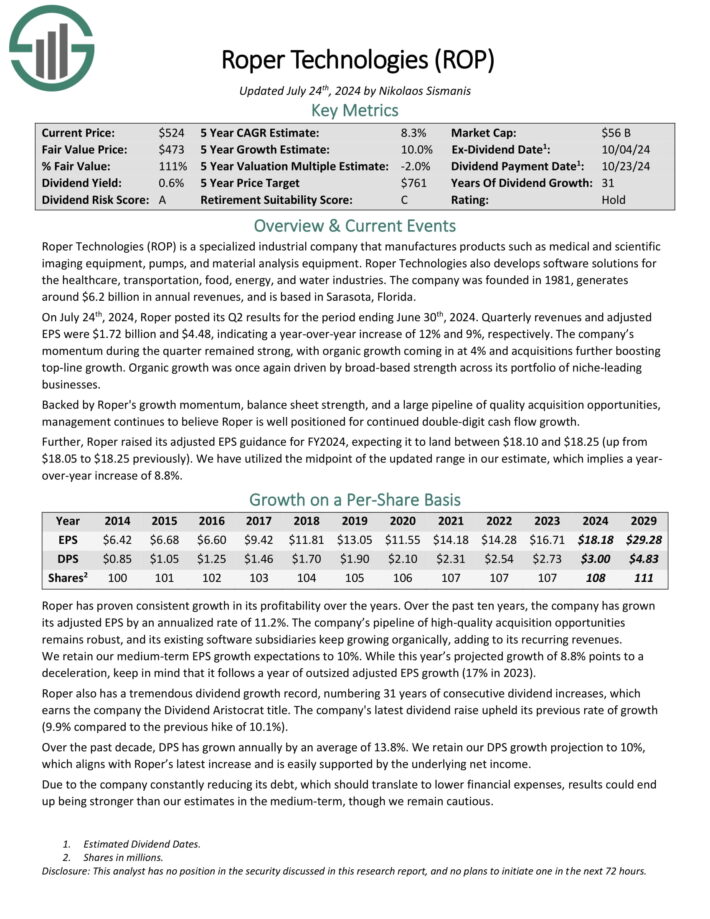

Tech Dividend Stock #10: Roper Technologies (ROP)

- 5-Year Annual Expected Returns: 7.0%

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment. Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries.

The company was founded in 1981, generates around $6.2 billion in annual revenues, and is based in Sarasota, Florida.

On July 24th, 2024, Roper posted its Q2 results for the period ending June 30th, 2024. Quarterly revenues and adjusted EPS were $1.72 billion and $4.48, indicating a year-over-year increase of 12% and 9%, respectively.

The company’s momentum during the quarter remained strong, with organic growth coming in at 4% and acquisitions further boosting top-line growth. Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses.

Backed by Roper’s growth momentum, balance sheet strength, and a large pipeline of quality acquisition opportunities, management continues to believe Roper is well positioned for continued double-digit cash flow growth.

Click here to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

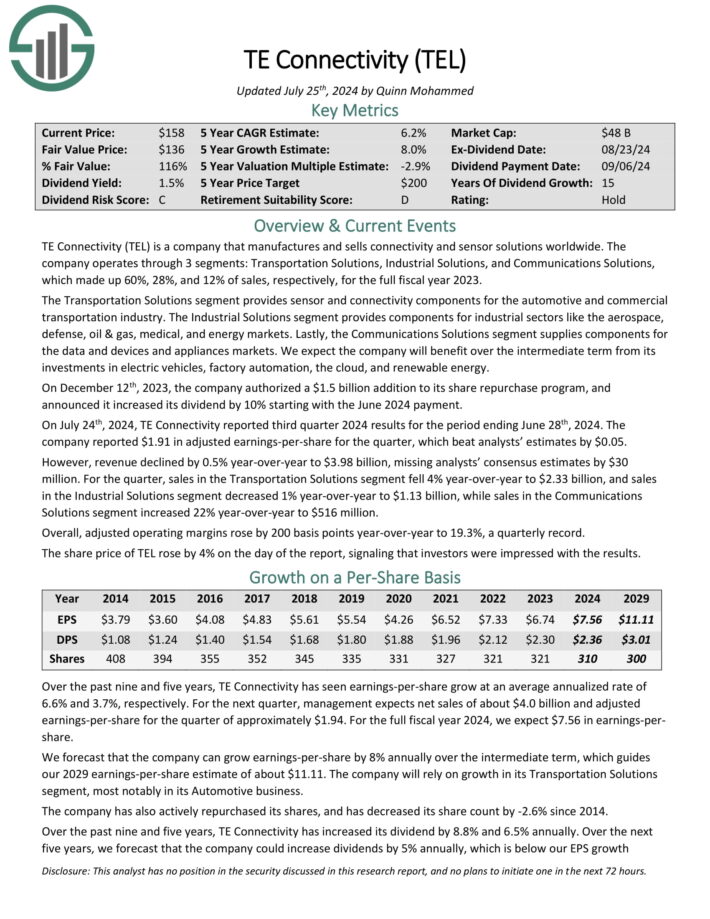

Tech Dividend Stock #9: TE Connectivity (TEL)

- 5-Year Annual Expected Returns: 7.5%

TE Connectivity is a company that manufactures and sells connectivity and sensor solutions worldwide. The company operates through 3 segments: Transportation Solutions, Industrial Solutions, and Communications Solutions, which made up 60%, 28%, and 12% of sales, respectively, for the full fiscal year 2023.

The Transportation Solutions segment provides sensor and connectivity components for the automotive and commercial transportation industry.

The Industrial Solutions segment provides components for industrial sectors like the aerospace, defense, oil & gas, medical, and energy markets.

Lastly, the Communications Solutions segment supplies components for the data and devices and appliances markets.

On July 24th, 2024, TE Connectivity reported third quarter 2024 results for the period ending June 28th, 2024. The company reported $1.91 in adjusted earnings-per-share for the quarter, which beat analysts’ estimates by $0.05.

However, revenue declined by 0.5% year-over-year to $3.98 billion, missing analysts’ consensus estimates by $30 million.

Click here to download our most recent Sure Analysis report on TEL (preview of page 1 of 3 shown below):

Tech Stock #8: Analog Devices (ADI)

- 5-Year Annual Expected Returns: 7.6%

Analog Devices (ADI) makes integrated circuits that are sold to OEMs (original equipment manufacturers) to be incorporated into equipment and systems for communications, computer, instrumentation, industrial, military/aerospace, and consumer electronics applications.

ADI has increased dividend payments to shareholders for 20 consecutive years.

On August 21st, 2024, Analog Devices reported third quarter 2024 results for the period ending August 3rd, 2024. For the quarter, the company reported revenue of $2.31 billion, down 25% compared to the prior year’s quarter, which beat analysts’ estimates by $40 million.

The company saw adjusted earnings-per-share of $1.58, which also beat analysts’ estimates by 7 cents but represented a 37% decline in EPS compared to the year-ago quarter. During the quarter, Analog Devices repurchased $118 million of its shares, and paid $456 million in dividends.

Click here to download our most recent Sure Analysis report on ADI (preview of page 1 of 3 shown below):

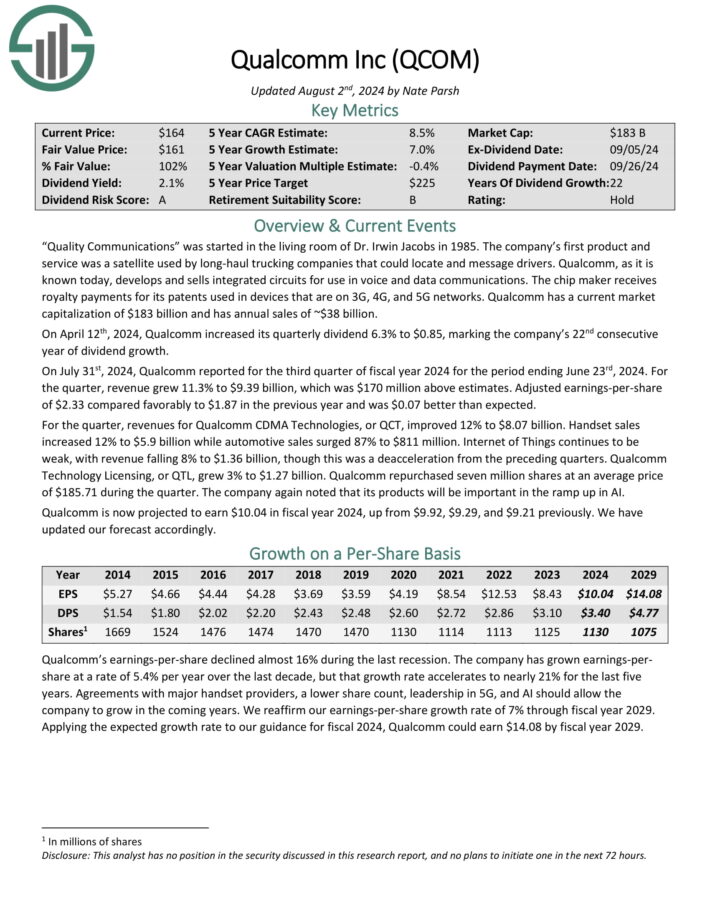

Tech Dividend Stock #7: Qualcomm Inc. (QCOM)

- 5-Year Annual Expected Returns: 7.6%

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm has annual sales of ~$38 billion.

On July 31st, 2024, Qualcomm reported for the third quarter of fiscal year 2024 for the period ending June 23rd, 2024. For the quarter, revenue grew 11.3% to $9.39 billion, which was $170 million above estimates. Adjusted earnings-per-share of $2.33 compared favorably to $1.87 in the previous year and was $0.07 better than expected.

For the quarter, revenues for Qualcomm CDMA Technologies, or QCT, improved 12% to $8.07 billion. Handset sales increased 12% to $5.9 billion while automotive sales surged 87% to $811 million. Internet of Things continues to be weak, with revenue falling 8% to $1.36 billion, though this was a deacceleration from the preceding quarters.

Qualcomm Technology Licensing, or QTL, grew 3% to $1.27 billion. Qualcomm repurchased seven million shares at an average price of $185.71 during the quarter. The company again noted that its products will be important in the ramp up in AI.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

Tech Dividend Stock #6: Cognizant Technology Solutions (CTSH)

- 5-Year Annual Expected Returns: 7.7%

Cognizant Technology Solutions provides information technology, consulting and business process outsourcing services in North America, Europe, and other regions. The company operates in four segments: financial services, healthcare, products & resources and communications, media & technology.

In late July, Cognizant reported (7/31/24) financial results for the second quarter of fiscal 2024. The currency-neutral revenue dipped -0.5% over the prior year’s quarter but adjusted earnings-per-share grew 6%, from $1.10 to $1.17, and exceeded the analysts’ consensus by $0.05 thanks to lower operating expenses and share repurchases. Bookings grew 4% over the prior year’s quarter, to $26.2 billion (~1.4 times annual sales).

As business momentum has somewhat improved, management raised its guidance for 2024. It still expects essentially flat revenues and a modest expansion of operating margin but it raised its guidance for adjusted earnings-per-share from $4.50-$4.68 to $4.62-$4.70. Accordingly, we have raised our forecast from $4.60 to $4.66.

Click here to download our most recent Sure Analysis report on CTSH (preview of page 1 of 3 shown below):

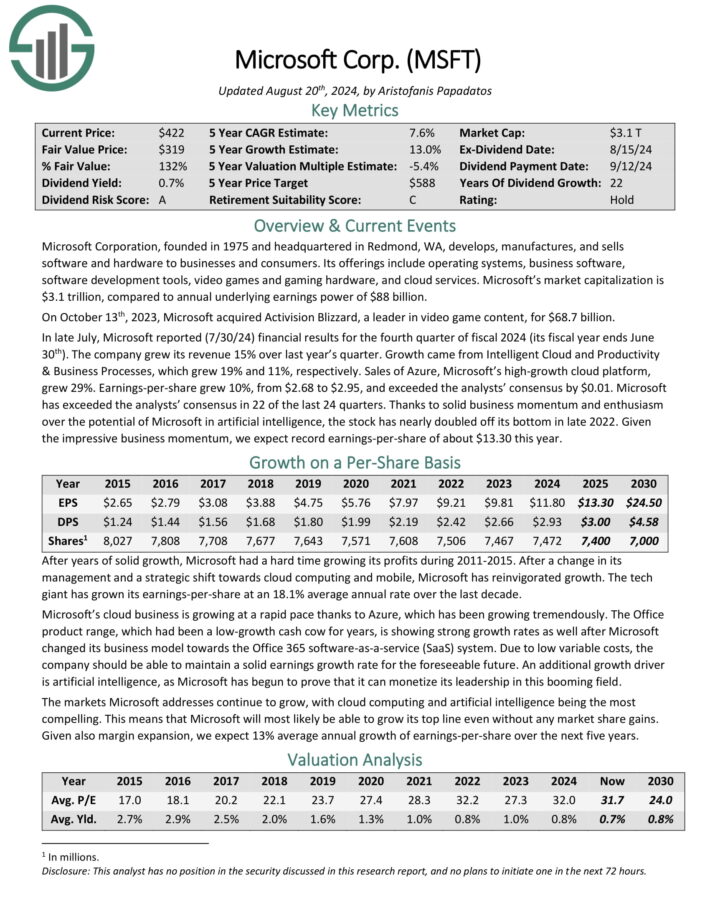

Tech Dividend Stock #5: Microsoft Corporation (MSFT)

- 5-Year Annual Expected Returns: 7.8%

Microsoft Corporation manufactures and sells software and hardware to businesses and consumers. Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

On October 13th, 2023, Microsoft acquired Activision Blizzard, a leader in video game content, for $68.7 billion. In late July, Microsoft reported (7/30/24) financial results for the fourth quarter of fiscal 2024 (its fiscal year ends June 30th).

The company grew its revenue 15% over last year’s quarter. Growth came from Intelligent Cloud and Productivity & Business Processes, which grew 19% and 11%, respectively. Sales of Azure, Microsoft’s high-growth cloud platform, grew 29%.

Earnings-per-share grew 10%, from $2.68 to $2.95, and exceeded the analysts’ consensus by $0.01. Microsoft has exceeded the analysts’ consensus in 22 of the last 24 quarters.

Click here to download our most recent Sure Analysis report on MSFT (preview of page 1 of 3 shown below):

Tech Dividend Stock #4: NXP Semiconductors (NXPI)

- 5-Year Annual Expected Returns: 9.5%

NXP Semiconductors is a semiconductor designer and manufacturer. It is headquartered in Eindhoven, Netherlands, and operates in over 30 countries with a workforce of approximately 31,000 employees.

NXP is a leading provider of innovative solutions for automotive, industrial, IoT, mobile, and communication infrastructure markets and holds over 9,500 patent families.

NXP Semiconductors N.V. reported financial results for Q2 2024 on the July 22nd, 2024. NXP reported quarterly revenue of $3.13 billion, which despite being a 5% year-over-year decline, aligned with their guidance and expectations across all focus end-markets.

Despite the lower revenue, the company achieved a GAAP gross margin of 57.3%, a GAAP operating margin of 28.7%, and a GAAP diluted net income per share of $2.54.

Click here to download our most recent Sure Analysis report on NXPI (preview of page 1 of 3 shown below):

Tech Dividend Stock #3: Juniper Networks (JNPR)

- 5-Year Annual Expected Returns: 9.6%

Juniper Networks aims to solve the world’s most difficult problems in networking technology through its products, solutions and services which connect the globe.

Juniper designs, develops, and sells switching, routing, security, software products and services for the networking industry.

JNPR sells its solutions in more than 150 countries. In 2023, the company earned $5.6 billion in revenue.

Juniper Networks reported second quarter 2024 results on July 25th, 2024. Net revenues for the quarter were $1.19 billion, down 17% year-over-year.

GAAP net income for the quarter was $0.10 per share, a 43% increase over $0.07 in the same prior year period. Non-GAAP net income was $0.31 per share, a 47% decrease over $0.58 in second quarter 2023.

The company repurchased $14.6 million of common stock for retirement year-to-date. Total cash, cash equivalents and investments were $1.43 billion at quarter-end.

Click here to download our most recent Sure Analysis report on JNPR (preview of page 1 of 3 shown below):

Tech Stock #2: Applied Materials (AMAT)

- 5-Year Annual Expected Returns: 9.7%

Applied Materials is a semiconductor manufacturer that generates roughly $27 billion in annual revenue.

Applied Materials posted third quarter earnings on August 15th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.12, which was a dime ahead of estimates. Revenue was also ahead by $110 million, rising 5.4% year-over-year to $6.78 billion.

Semiconductor Systems revenue was $4.92 billion, a year-over-year increase of $248 million. The company noted it believes it’s well-positioned in the AI race, which should continue to fuel demand for its products and services.

Cash from operation was $2.39 billion during the quarter, and $1.19 billion was distributed to shareholders. That included $861 million in share repurchases and the balance in dividends.

Click here to download our most recent Sure Analysis report on AMAT (preview of page 1 of 3 shown below):

Tech Dividend Stock #1: Intuit Inc. (INTU)

- 5-Year Annual Expected Returns: 10.8%

Intuit is a cloud-based accounting and tax preparation software giant. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide.

Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers. The company recorded $16.3 billion in revenues last year.

On August 22nd, 2024, Intuit raised its dividend by 16% to a quarterly rate of $1.04. On the same day, Intuit reported its Q4 and full-year results for the period ending July 31st, 2024. Intuit published another robust quarter, growing its “Small business and Self-employed” revenue by 20% and its online ecosystem revenue by 18%.

QuickBooks Online accounting revenues grew 17% year-over-year as well. Total revenues for the quarter reached $3.18 billion, up 17% year-over-year.

Adjusted EPS for the quarter grew by 21% to $1.99 compared to FQ4 2023. For the year, adjusted EPS came in at $16.94, up 18% compared to the previous year.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

Final Thoughts

The technology sector has become an intriguing place to look for high-quality dividend investment opportunities.

With that said, it is not the only place to look for investment ideas.

If you’re willing to venture outside of the technology sector, the following databases contain some of the most high-quality dividend stocks around:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers List: Dividend stocks with 10+ years of consecutive dividend increases

- The Dividend Kings List: Dividend stocks with 50+ years of consecutive dividend increases

- The Blue Chip Stocks List: Dividend stocks that qualify as either Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

- The Complete List Of Utility Stocks

- The Complete List Of Communication Services Stocks

- The Complete List Of Consumer Staples Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Financial Stocks

- The Complete List Of Real Estate Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks